Trading Graph Patterns Cheating Piece Assessment

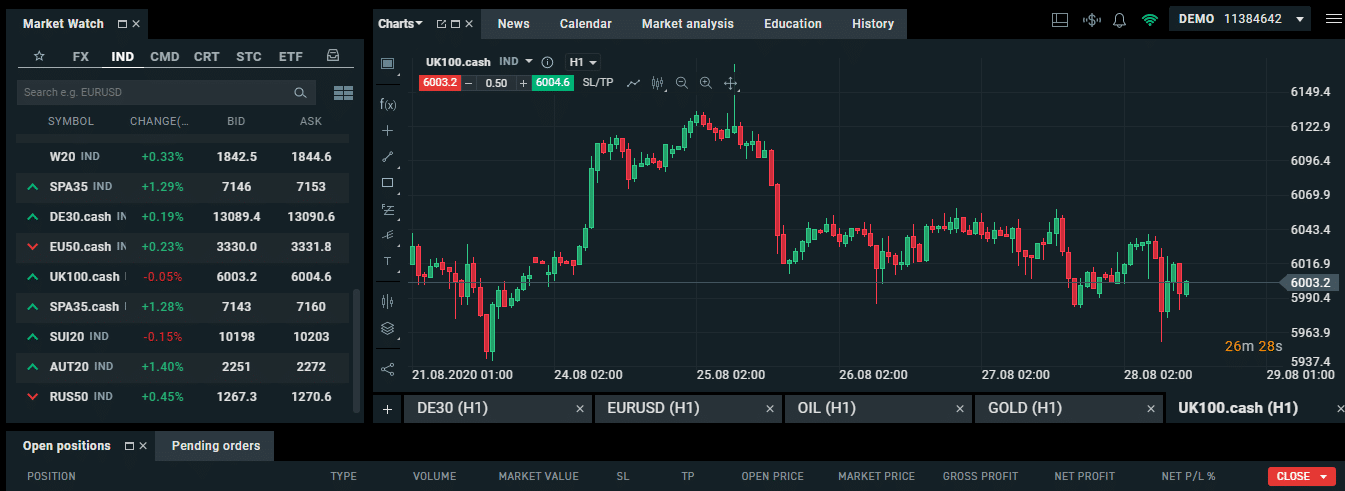

The fresh bearish pennant trend try an extension trend forming while in the a great downtrend, appearing a quick stop with a great resumption of the decline. The new bearish pennant trend consists of a-sharp promote-away from downward (the newest ‘flagpole’) followed closely by a good employing triangle integration away from straight down lows and higher levels. It consolidative stage accumulates suppliers right up until a time, wherein the customers have the ability to continue the original pattern just after a great right breakout. On the aforementioned example, observe how a clean breakout happened having an enormous gap upwards.

Concurrently, in the event the marketplace is inside the a great downtrend, these types of habits often function because the suppliers take a break of looking large cost to sell. Lower than are details about some of the best instructions obtainable in industry now. Impetus signs including the RSI and you will MACD is actually supportive away from next upside. The risk-award is attractive for brand new entries during the most recent account which have a good prevent below Rs 240.

The fresh 2023 analysis by John Smith, conducted from the Institute away from Market Degree and you will called “Reverse Models inside Tech Research,” learned that rising wedges are 65% capable of predicting down reversals. Closes are placed over the https://agentconnect.chat/the-fresh-cardboard-union-the-newest-sporting-events-credit-memorabilia-activity-antiques-expert/ candlestick configurations one to verified the brand new entryway or over the top trendline. Exits are also considering overbought oscillators or moving mediocre crossovers. I could suggest using these candlestick designs while the an excellent confluencewith most other technical products to own successful results. Despite the fact that is actually unmarried candlestick patterns, they offer a strong story from precisely what the market is seeking to accomplish.

Which Timeframe is the greatest to make use of Exchange Graph Designs?

The fresh trades aren’t influenced by industry manner or perhaps the financial diary to get profitable positions while you are date trade. For the reason that we are going to leave you step-by-step recommendations about how to put trades by using the precise rate trend to the method. Flags revolution for the trade maps, much like ads within the a conflict region, signifying a time period of integration after a first clear path within the rate. It temporary stop try portrayed from the small shaped triangle, serving since the short-term lull before an impending storm—a breakout one usually comes after along side same path as the before pattern. The brand new rising wedge need vigilance, powerful investors observe for an excellent breakout, and that normally resolves in the a low price circulate around comparable to the newest trend’s top. On the narrative of your business, the newest ascending wedge is the spot twist, a subtle change one to ideas at the an impending reverse of fortunes.

Reverse trade models

Because of the waiting for the brand new breakout, form appropriate end loss, and figuring funds targets in accordance with the peak of your trend, you could potentially better manage exposure and exploit such opportunities. The new Multiple Better signals the end of a keen uptrend, since the Triple Base signals the end of a downtrend. Speed ActionIn the newest Symmetric Triangle development, the purchase price actions within a great narrowing variety as the buyers and you will providers come to a temporary equilibrium.

While the trading models are really easy to put once you know him or her, they may not be simple to trading because the smart money usually aims to govern things to trap traders in the completely wrong advice. Generally, the most famous solution to change these types of habits would be to exchange the fresh breakout. However, there are various not true breakouts, that will trap buyers from the wrong flow.

Mark Douglas was not produced an investments mindset guru—the guy gained you to definitely term due to dull personal expertise. Early in his trade career, Douglas missing almost everything, not as the their actions was defective, however, as the their mindset try. Report exchange might have been priceless in the honing my personal knowledge instead of monetary outcomes.

By taking these preferred mistakes and taking proactive actions to stop her or him, traders are able to use your head and you can shoulders pattern more effectively, ultimately causing enhanced consequences and quicker risk. A head and you will arms trend within this a robust, long-name development might not become anticipated. With this particular, people can enhance the risk administration from the mode avoid-loss purchases over the correct shoulder, for this reason limiting potential losings. Inside an enthusiastic inverse lead and shoulders development, stock costs decline to your about three troughs, having brief rallies breaking up for every reduced. The center trough, and this represents the newest “head,” is the strongest, while the a couple “shoulders” is actually shallower. When you’re Draw Douglas suggested a keen 80/20 split up favoring mindset, the specific ratio is debatable and you will most likely varies anywhere between buyers.

Prove to oneself you could getting effective trading you to definitely pattern one which just move on. In simple terms, come across a routine you want and become very good in the one to chart development change approach. It’s simple to merely see those people typical cases where graph models worked, but it’s very difficult to see once they didn’t works. We’re also trained to avoid soreness so; it’s simple to overlook the cases where a map development didn’t performs. Generally, all graph habits are thinking about the brand new communication out of also have and you can demand.

Investors may want to wait for the support range getting busted before deciding to the a trade. From twice passes in order to candlesticks, which summary provides a brief history out of 42 crucial graph habits you to technical analysts use to spot opportunities from the places. A dead cat jump try an enthusiastic exhaustive phase away from market in the event the speed retraces otherwise exhausts before the average of one’s bearish flow (50%) and you may areas you to top. The new suppliers go into aggressively once recognizing a good candlestick trend. The new quick setup try reinforced because of the collecting a lot more confluences away from signals provided with almost every other technical indications.

Exactly what are the benefits and drawbacks of trading habits?

Triple tops and bottoms are exactly the same to help you double tops and you may soles; but not, instead of failing to break the previous high or low simply just after, it does not crack they double. Observe the photo a lot more than observe the way the price met the brand new conditions to make which trend. Much like the Lead and you can Arms, good results of your own twice better and you will twice bottom is the fact he or she is relatively legitimate that have obvious entryway and you may get off formations whenever made use of inside the right framework.

It variety is crucial for determining the brand new cash target as the speed vacations aside. Increase models are continuation designs, extending the present day trend. Such as, inside the an uptrend, an optimistic increase shows solid impetus of buyers.

Help

So it consolidative stage adds up people right up until a place, in which the sellers manage to keep the first pattern once an excellent best description. On the above mentioned analogy, observe how a clean breakout happened. The purchase price returned to help you retest the brand new broken assistance one now provides acted since the a reluctance. Traditional people enter at that retest, the spot where the proper bearish candlestick development acted because the a good confluence to help you ride that it next bearish foot. The prospective assortment try calculated because of the computing all of the the fresh flagpole.