Better bank threats to have 2024

Content

If a student otherwise parent cancels an approval to use FSA fund to pay for most other allowable charges, the college can use FSA fund to spend only those subscribed fees obtain because of the scholar before the college received the newest notice. Direct Mortgage finance which can be came back inside 120 times of the fresh disbursement because of the college or the debtor, unconditionally, try handled while the a limited or full cancellation, to the compatible changes of one’s financing percentage and you will desire. At the same time, Direct Mortgage finance that will be came back by the a college any kind of time time for you to comply with a regulating or statutory specifications is actually managed because the a partial or complete termination. The amount of Snap professionals a family gets is based on an algorithm which takes into consideration its dimensions, earnings, and you can expenses.

Our very own strategy to have rating examining membership

As entitled to get the disbursement to own guides and supplies, students must meet all the pupil qualifications conditions through to the start of the student’s commission months. A school’s policy have to allow it to be students to help you decline to participate in the procedure the institution offers you could look here up the new college student discover or get courses and you can supplies. A college filled with the expenses of courses and you may provides inside the brand new university fees charged and provides all of those material to your college student at the outset of their categories matches the needs of such legislation. If the, inside analogy, ECB credited $600 from Pell Grant money, rather than $five hundred, a name IV borrowing equilibrium away from $100 would be composed while the overall FSA financing credited so you can the brand new membership ($step one,600) create go beyond the fresh deductible costs ($step 1,500). Your college has the option of paying the express from an excellent student’s FWS earnings in the way of a great noncash sum out of features otherwise devices— such, university fees and you can fees, space and panel, and/or books and provides. But not, you might not amount forgiveness of a charge, such as a FWS scholar’s parking fine otherwise collection good, as part of the noncash share on the pupil.

Better Cd cost today from the label

You utilize your car to check out the new organizations out of customers, speak to services and other subcontractors, and choose up and deliver points to customers. There is absolutely no other business use of the car, however you along with your family members utilize the vehicle private aim. You retain adequate facts inside the very first few days of every week that demonstrate you to definitely 75% of one’s use of the automobile is for team.

She before modified blogs to the individual finance information in the GOBankingRates. The girl performs has been appeared by Nasdaq, MSN, TheStreet and you may Bing Finance. A college need use in the brand new records it keeps all of the research that the cobranded economic account otherwise accessibility product is offered fundamentally to the social. Availableness unit—a card, password, or any other a style of usage of a monetary membership, otherwise one combination thereof, which can be used by a student to help you initiate digital finance transmits.

How Higher Tend to Offers Rates Enter 2025?

If you have zero regular work environment but typically functions in the urban town your location, you might deduct everyday transportation costs between household and you may a short-term work website outside you to definitely metropolitan town. Transportation expenses include the ordinary and needed costs of all of next. These deduction is known as an excellent various deduction which is no more allowable considering the suspension from various itemized write-offs susceptible to the 2% floors lower than section 67(a).. If you provide something special to help you a part away from a customer’s family members, the brand new current may be reported to be a secondary current in order to the consumer.

- You’ll have the choice add your setting(s) online or download a copy to possess emailing.

- Listed below are some more what you should watch out for with regards to an excellent financial indication-right up bonus.

- The brand new noncurrent speed improved four foundation things on the prior one-fourth to help you 0.91 percent, an even nonetheless well below the pre-pandemic mediocre noncurrent speed of 1.28 percent.

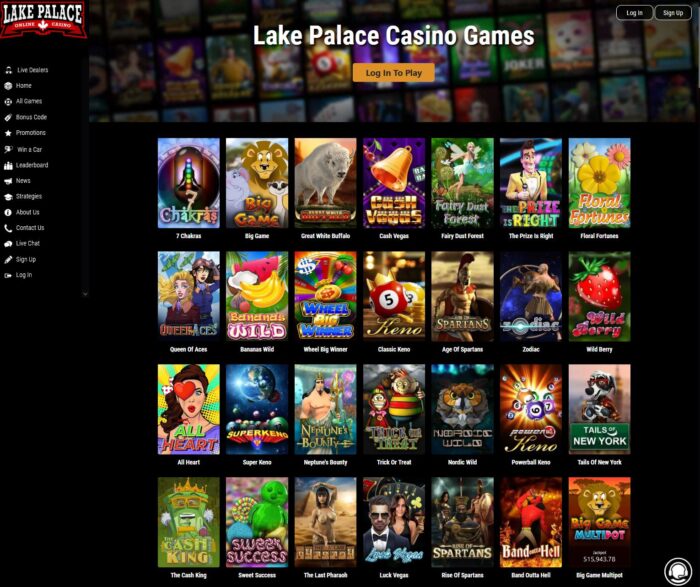

- That it level of put also provides a balance anywhere between cost and use of a wider list of video game, enabling participants to understand more about more choices.

The trick try picking one that costs pair charge if you are delivering a great customer care and you will a simple electronic sense. Because of this i scoured more than 300 accounts certainly almost 150 loan providers to discover the best of them. NFL BetVision allows customers stream in the-network and you will in the united states televised NFL video game in person inside DraftKings Sportsbook app because of the establishing a wager on case. Available in U.S. jurisdictions in which DraftKings Sportsbook operates and Ontario, Canada, the fresh function helps incentive bets and you can stays productive whether or not your wager settles before game closes.

Credit Human Show Certificates

Weiss added you’re maybe not usually swinging currency anywhere between examining and deals profile. When your equilibrium is higher than your own barrier, believe transferring from the checking in order to savings. Any cash with other intentions otherwise needs, such as an emergency fund, will be kept in offers. “You don’t want to feel like you could potentially purchase one to money,” Weiss told you. If you are debit card advantages aren’t as the glamorous as the playing cards, you could nonetheless get some — compared to no benefits usually given thru dollars deals.

If you’re a person who utilizes dining stamps to aid lay eating available, then you definitely probably know already how vital it’s to own factual statements about in case your advantages was deposited. Knowing the accurate go out their benefits will be available can help your budget the grocery shopping and you will plan your diet consequently. That being said, it’s imperative to see the process of when dining seal of approval is actually deposited into the account. For individuals who’re unclear whether you should be spending otherwise preserving, it’s a legitimate concern. Each other provides merits, and this will very confidence the place you’re at the on your monetary travel.